Credit Cards, Clearly.

Compare. Choose. Win. India’s smartest way to discover the best credit card for your lifestyle.

🔒 Trusted by 1,00,000+ Indians

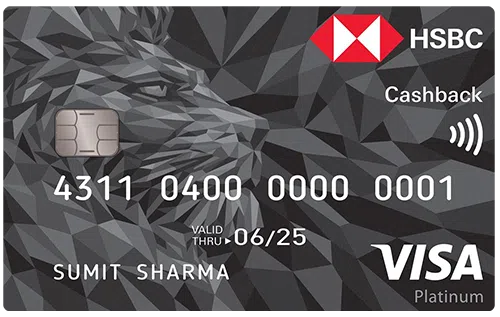

🔥 Trending Cards This Week

🏅 Credofly Signature™

Our exclusive list of the best credit cards in India – fully editorial, updated twice a year.

Explore Signature Cards🔍 What Are You Looking For?

📉 Stay Ahead of Credit Card Nerfs

Don’t let banks silently slash your rewards, lounge access, or fee waivers. Track every change with Credofly Tracker™.

💬 What Experts Say

Trusted by credit card pros, points influencers, and finance creators.

🛡️ Trusted by 1,00,000+ Card Users Across India

Our community-first approach, honest reviews & real results make the difference.

1L+ Users

India’s most helpful credit card community, growing every day.

4.8/5 Rating

Based on 3,200+ user feedback ratings on cards & posts.

Zero Ads. 100% Honest.

No paid promotions. Just data-driven, user-verified reviews.

💬 Why Credofly?

Built by Users, for Users

Our reviews are shaped by real feedback, discussions, and personal stories from India’s largest credit card community.

Clear, Honest Reviews

No confusing jargon. No fine print traps. Just honest, practical information you can use.

Find the Right Card Fast

Our decks, top picks, and filters help you discover the best card for your needs — in minutes.

💬 What Experts Say

Trusted and followed by credit card pros, points influencers, and finance creators.

Credofly is seriously building something useful. Clean reviews, great UI, and real community power.

View Tweet →This is the kind of credit card content India needs. Credofly team is doing solid work!

View Tweet →Credofly reviews are crisp, honest, and super helpful for anyone choosing a new card.

View Tweet →🔵 Join Credofly Circle

India’s smartest credit card user community. Ask questions, share hacks, and learn from real users across the country.

Join Free📂 Too Many Credit Cards?

Use Credofly Stack to track all your cards, benefits, fees, and renewal dates in one secure place.

Start Tracking✨ Learn Smart. Spend Smarter.

Spark is your credit card learning hub – from beginner basics to expert hacks. No fluff, just facts.

Start Learning📬 Stay in the Loop

Get weekly updates on new cards, cashback changes, hidden rewards & limited-time offers. Directly in your inbox.

Subscribe Free