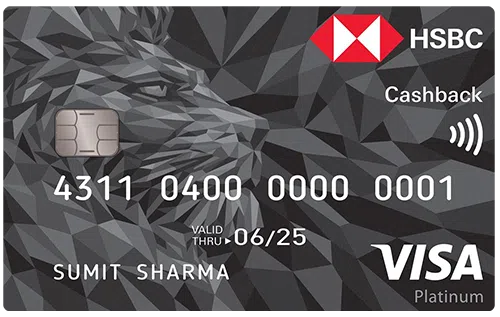

HSBC Bank

HSBC Premier MasterCard Credit Card

Travel and Rewards

₹12,000 + GST

₹20,000 + GST

Card Details

The HSBC Premier Credit Card is built for elite HSBC Premier clients, offering exceptional lifestyle and travel benefits. Cardholders enjoy 3X reward points, unlimited lounge access, and premium memberships with Taj and EazyDiner. With a low forex markup and strong redemption flexibility, it’s one of India’s most value-rich premium cards.

Available Networks: MastercardReward Details

-

3 Reward Points per ₹100 on eligible retail, travel, and dining spends

-

Wallet loads, rent, utilities, insurance & taxes: 3 RP/₹100 up to ₹1L/month

-

No reward points on fuel

-

Points never expire and can be redeemed at 1:1 for airmiles or ₹1/point for Apple products

Best Suited For

You will get high Reward Points as compared to other credit cards

Earn 3 Reward Points per ₹100 spent on most categories. Wallet loads, rent, utilities, insurance, and tax/government spends earn 3 RP/₹100 only up to ₹1L/month. No reward points on fuel.

Milestone Details

N/A

Reward Redemptions

-

1:1 transfer to 20+ frequent flyer programs

-

₹1 = 1 RP for Apple products (via Imagine vouchers)

-

Redeem for vouchers, catalog items, travel, and experiences

-

No expiry on reward points

Excluded Spend Categories

You wont get any Reward Points for following spend types

Pros of HSBC Premier MasterCard Credit Card

Unlimited lounge access worldwide (primary user)

3X reward points with strong redemption flexibility

₹12,000 Taj Gift Card + memberships worth ₹10K+

Cons of HSBC Premier MasterCard Credit Card

Only for existing HSBC Premier customers

No rewards on fuel spends

Wallet, rent, and utility rewards capped at ₹1L/month

Why We Like It

A luxurious card with exceptional perks: unlimited lounge access, 3X rewards, elite brand tie-ups, and global usability. Perfect for frequent travelers and HNIs with HSBC Premier.

Application Process

Apply via Credofly in just 2 minutes:

Complete the application, upload documents, and finish Video KYC. Card is delivered within 5–7 working days.

Card Eligibility

-

Must be an HSBC Premier customer

-

Premier eligibility:

• Maintain ₹40L Total Relationship Balance (TRB), or

• Home loan disbursal of ₹1.15Cr+, or

• ₹3L+ monthly salary in an HSBC Premier corporate account

Conclusion

HSBC Premier Credit Card delivers luxury, travel, and reward excellence in one package. It shines with unlimited lounge access, premium dining partnerships, and versatile reward redemptions. If you’re an HSBC Premier client, this card is a no-brainer — especially with its low forex markup and waived annual fee. One of the best value-for-benefit premium cards in India.